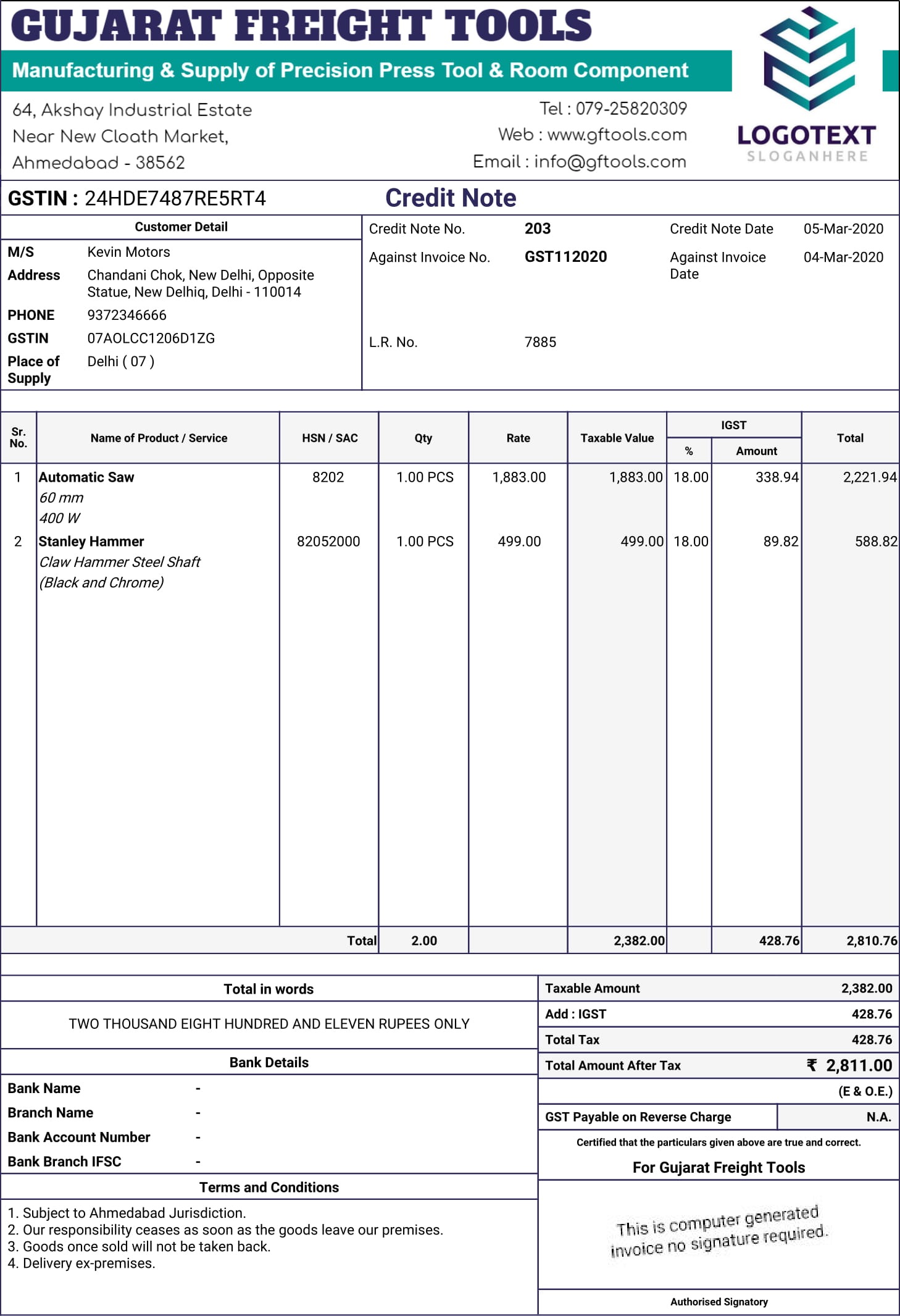

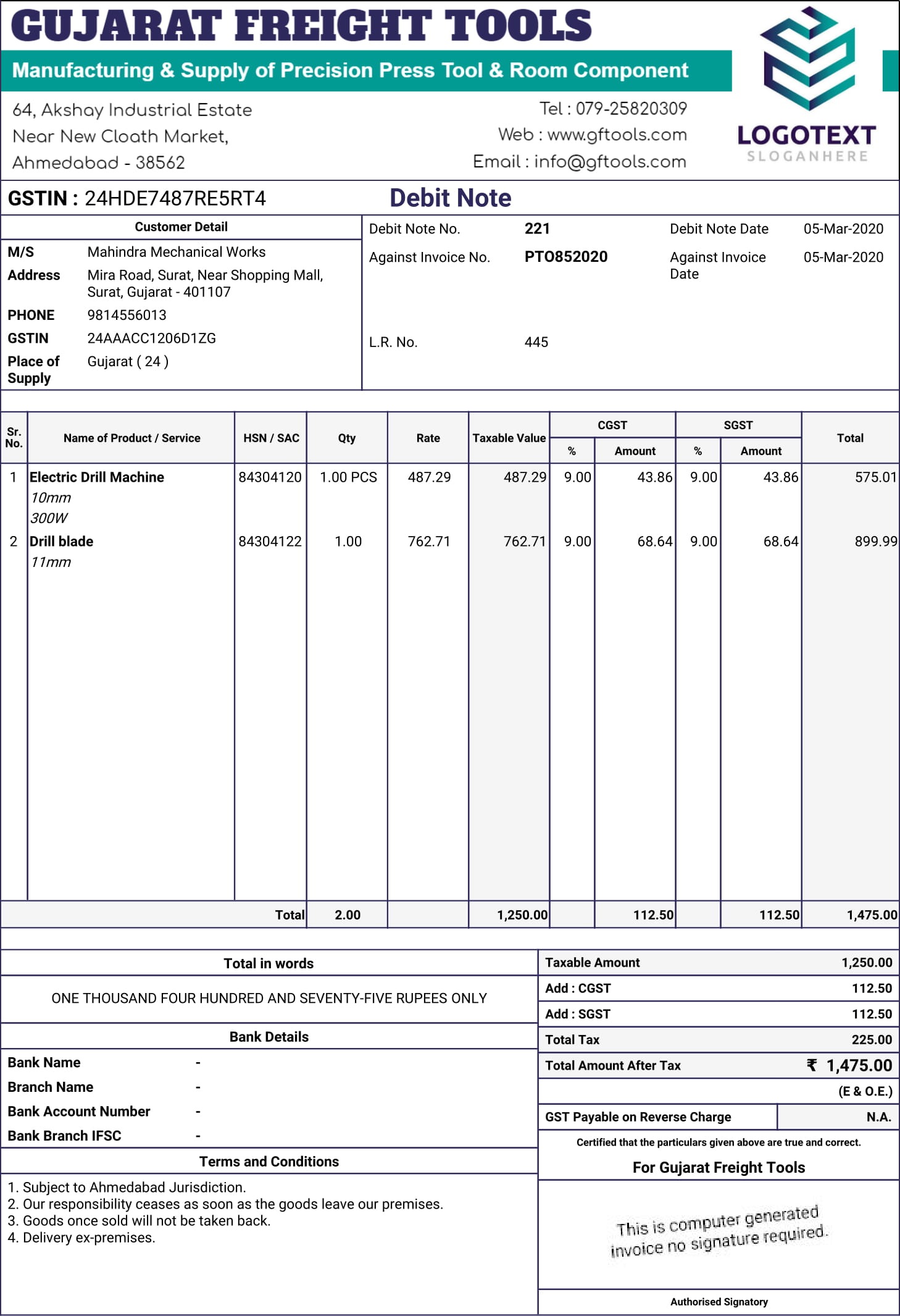

In a business, suppliers issue GST invoices quite frequently. However, there are circumstances when an already issued invoice needs to be amended due to the rejection of a few products or add up a few products as the case may be. In this situation, the need for credit and debit note arises. When the amount needed to pay is reduced due to the cancellation of goods, then a credit note is issued while when the amount required to pay is extended due to adding up of products, then a debit note is issued.

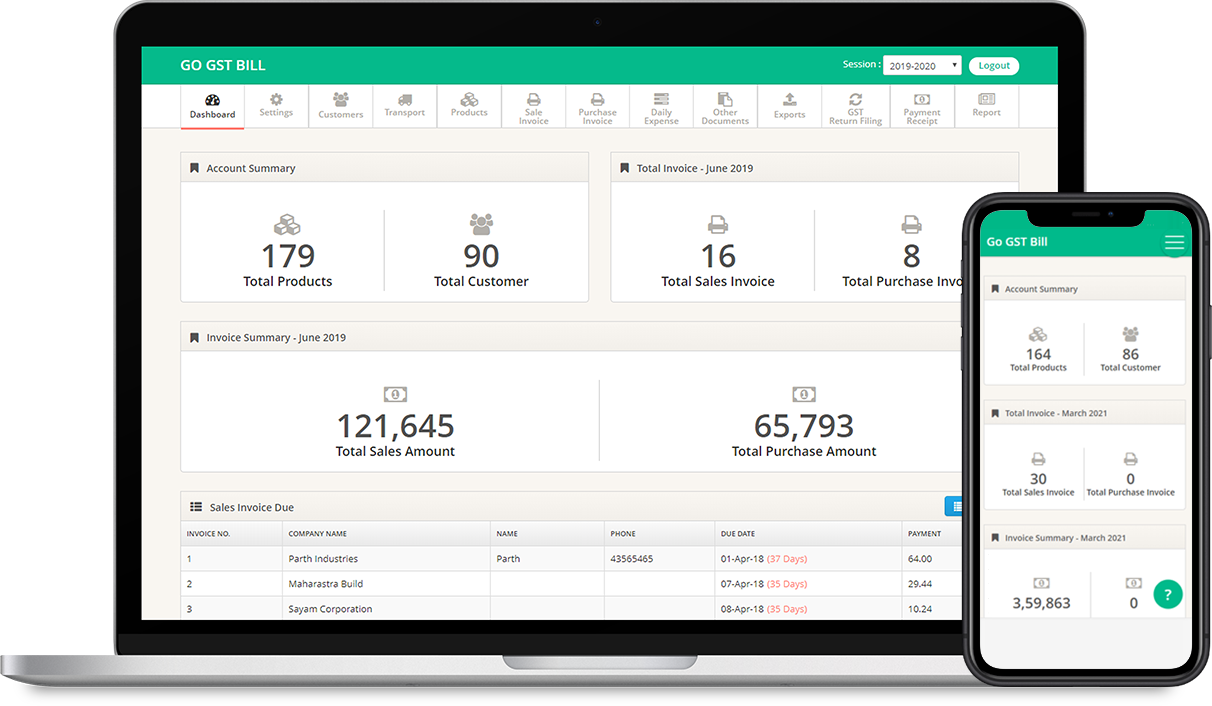

With GoGSTBill billing software, you can easily create a GST Credit Note & Debit Note with just a few clicks. Click here to create your account in GoGSTBill billing software.